Documents

Supplemental Documents

These templates or documents may be necessary to get an agreement.

Base Year Submission Checklist

Supplemental Entity Schedule

The Nebraska Department of Economic Development and Department of Revenue are using the State File Sharing system (ShareFile) to receive supplemental information from ImagiNE Act applicants or their designated representatives.

For instructions on how to use this system, please refer to the presentation PDF. To access the system, click the button below.

Guidance

Memo 20-1 Sufficient Benefits Memorandum

Revised August 16, 2021

Memo 21-01 Placed in Service

Memo 21-02 Pre-production Services

Memo 21-04 Economic Redevelopment Areas (ERA)

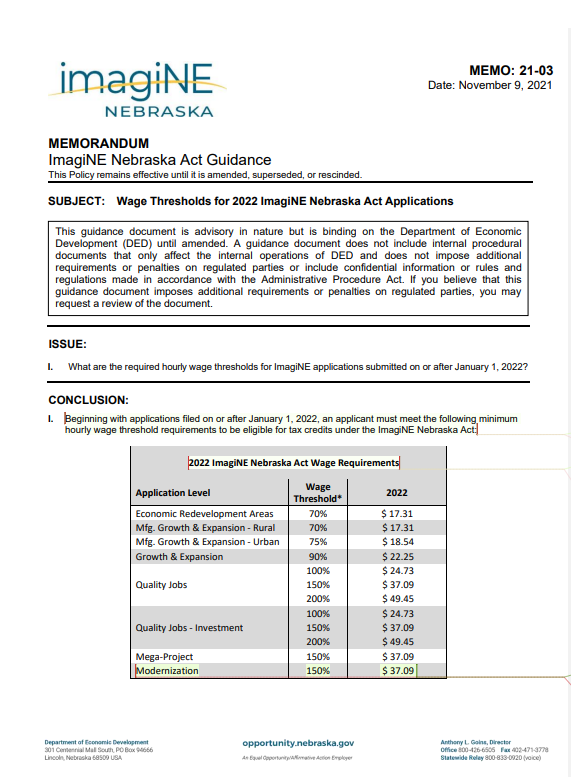

Memo 24-01 Wage Thresholds for 2024 ImagiNE Nebraska Act Applications

Application Guide

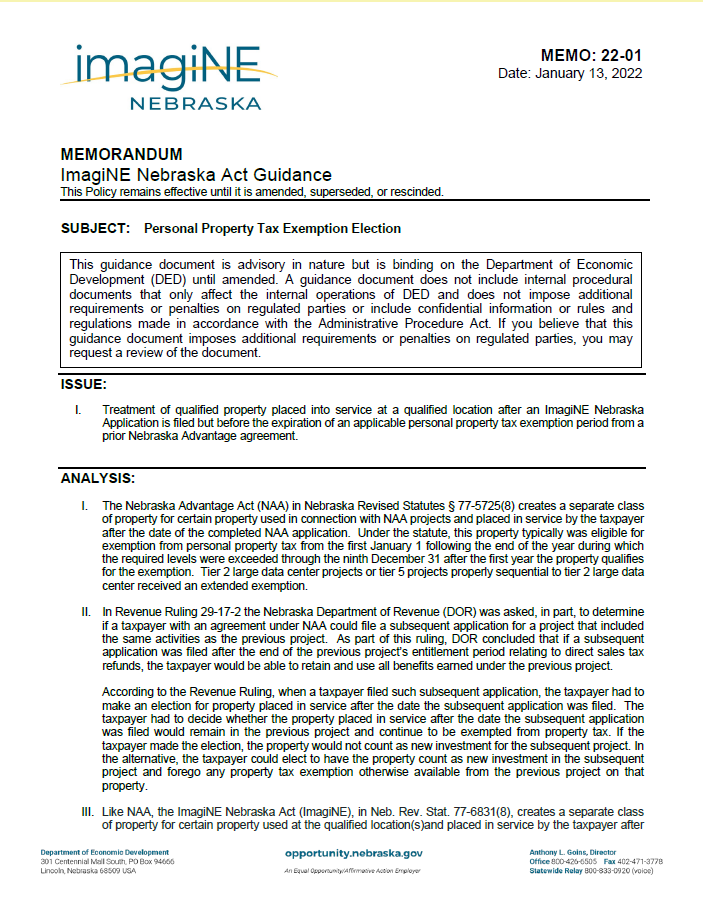

Personal Property Tax Exemption

Forms and Instructions

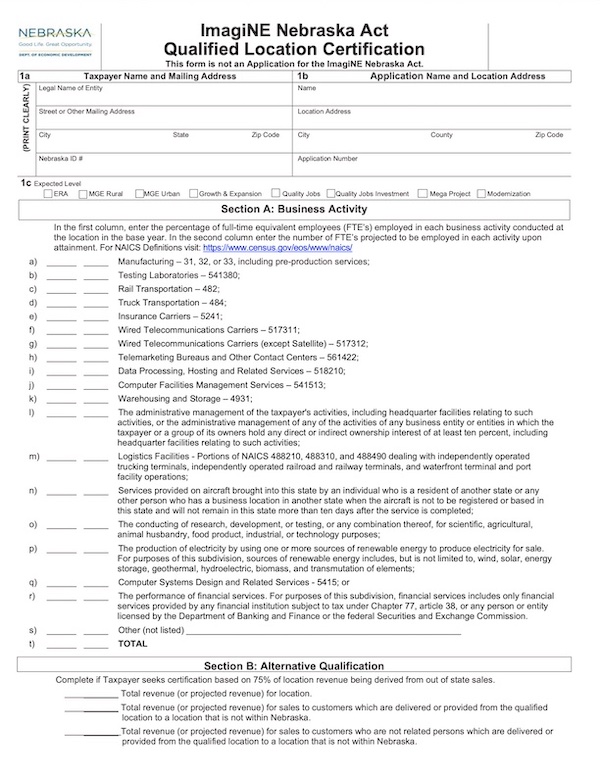

Qualified Location Certification

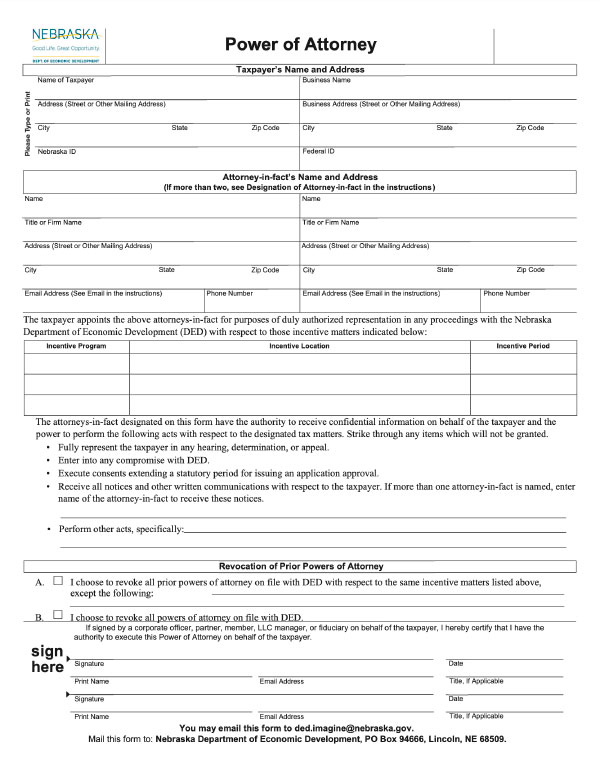

Power of Attorney Form

Online Application Template

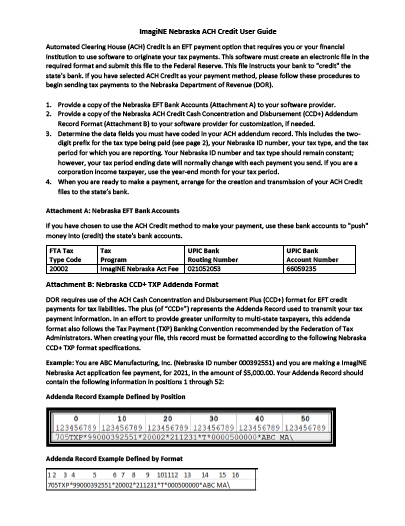

imagiNE Nebraska ACH Credit Instructions

Application Guide

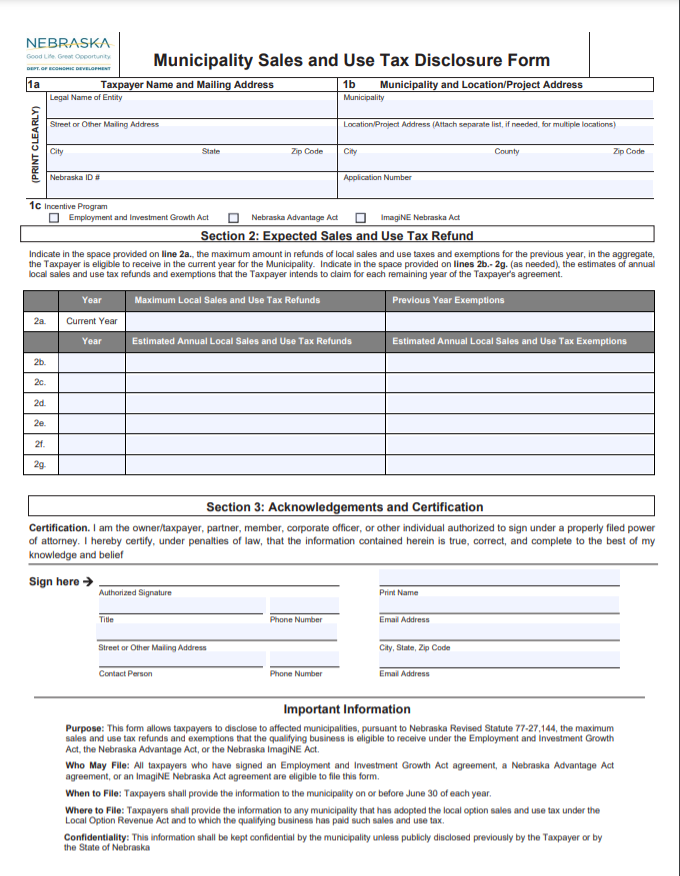

Municipality Sales and Use Tax Disclosure Form

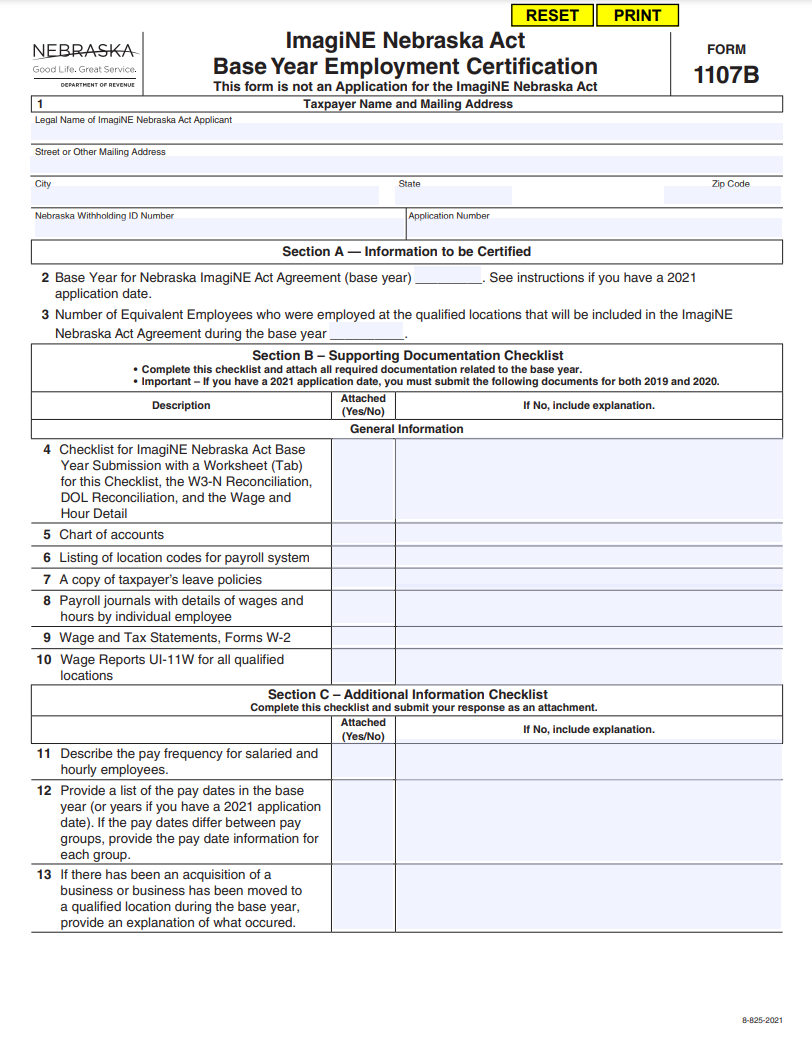

Base Year Employment Certification

Base Year Certification Checklist

Job Training Expense Reimbursement Template

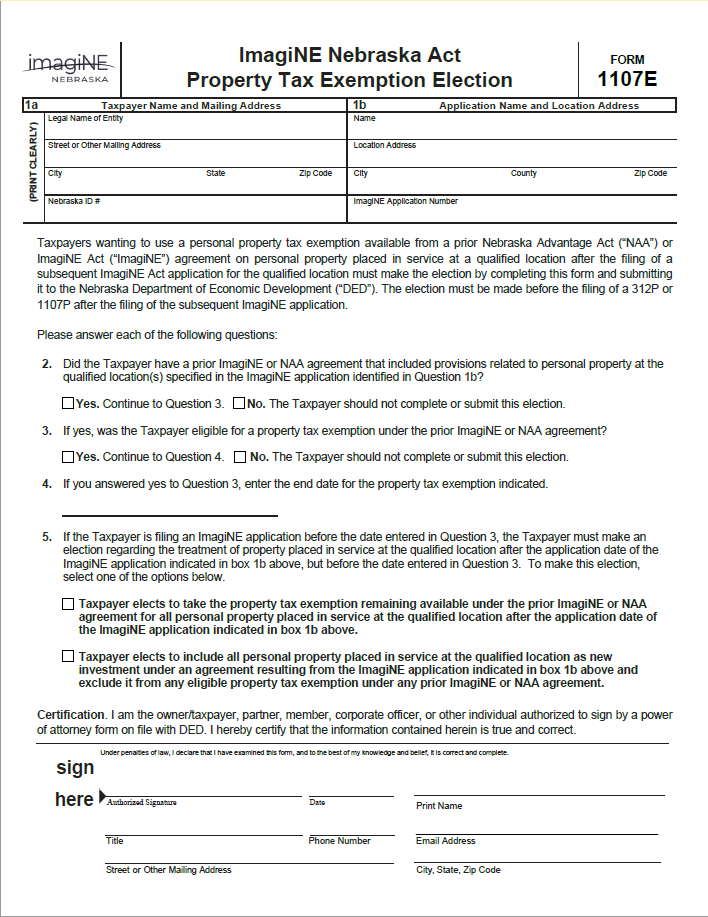

Property Tax Exemption Election Form

Reports

Application Reports

Agreement Reports

Credits and Refunds Reports

Statutes

ImagiNE Statutes

- 77-6801 Act, how cited.

- 77-6802 Policy.

- 77-6803 Definitions, where found.

- 77-6804 Additional definitions.

- 77-6805 Base year, defined.

- 77-6806 Base-year employee, defined.

- 77-6807 Carryover period, defined.

- 77-6808 Compensation, defined.

- 77-6809 Director, defined.

- 77-6810 Equivalent employees, defined.

- 77-6811 Investment, defined.

- 77-6812 Motor vehicle, defined.

- 77-6813 NAICS, defined.

- 77-6814 Nebraska statewide average hourly wage for any year, defined.

- 77-6815 Number of new employees, defined.

- 77-6816 Performance period, defined.

- 77-6817 Qualified employee leasing company, defined.

- 77-6818 Qualified location, defined.

- 77-6819 Qualified property, defined.

- 77-6820 Ramp-up period, defined.

- 77-6821 Related persons, defined.

- 77-6822 Taxpayer, defined.

- 77-6823 Wages, defined.

- 77-6824 Year, defined.

- 77-6825 Year of application, defined.

- 77-6826 Qualified employee leasing company; employees; duty.

- 77-6827 Incentives; application; contents; fee; approval; when; application; deadlines.

- 77-6828 Agreement; requirements; contents; confidentiality; exceptions; duration of agreement; incentives; use.

- 77-6829 Qualified locations; base-year employment, compensation, and wage levels; review and certification; effect.

- 77-6830 Transactions and activities excluded.

- 77-6831 Tax incentives; amount; conditions; fee; ImagiNE Nebraska Cash Fund; created; use; investment.

- 77-6832 Income tax credits; use; tax incentive credits; use; refund claims; filing requirements; audit; director; Tax Commissioner; powers and duties; appeal.

- 77-6833 Incentives; recapture or disallowance; conditions; procedure.

- 77-6834 Incentives; transferable; when; effect.

- 77-6835 Refunds; interest not allowable.

- 77-6836 Application; valid; when; director; Tax Commissioner; powers and duties.

- 77-6837 Reports; joint hearing.

- 77-6838 Rules and regulations.

- 77-6839 Tax incentives; estimates required; when; exceed base authority; limit on applications.

- 77-6840 Employment and wage data information; Department of Labor; duty.

- 77-6841 Workforce training and infrastructure development; revolving loan program; legislative findings; Department of Economic Development; duties; ImagiNE Nebraska Revolving Loan Fund; created; use; investment.

- 77-6842 Workforce training loan; application; partnering entities; loan approval; factors considered.

- 77-6843 Infrastructure development loan; application; approval; factors considered.

Stay in the know

Stay up to date on the latest information about the ImagiNE Incentives Program. Join our mailing list: